A First-Principles Analysis of Landed Costs, Cash Flow, and Optimal Pathways #

Claim: “The advice that worked for your parents’ generation is now structurally impossible. Most parents don’t know this yet. Most students find out too late. This analysis documents what actually works under current conditions, using probability modeling instead of hope.”

Created: September, 2025 – Last updated: February, 2026

The “Failure to Launch” narrative is mathematically illiterate and generationally destructive. #

Author’s Note on Scope and Methodology #

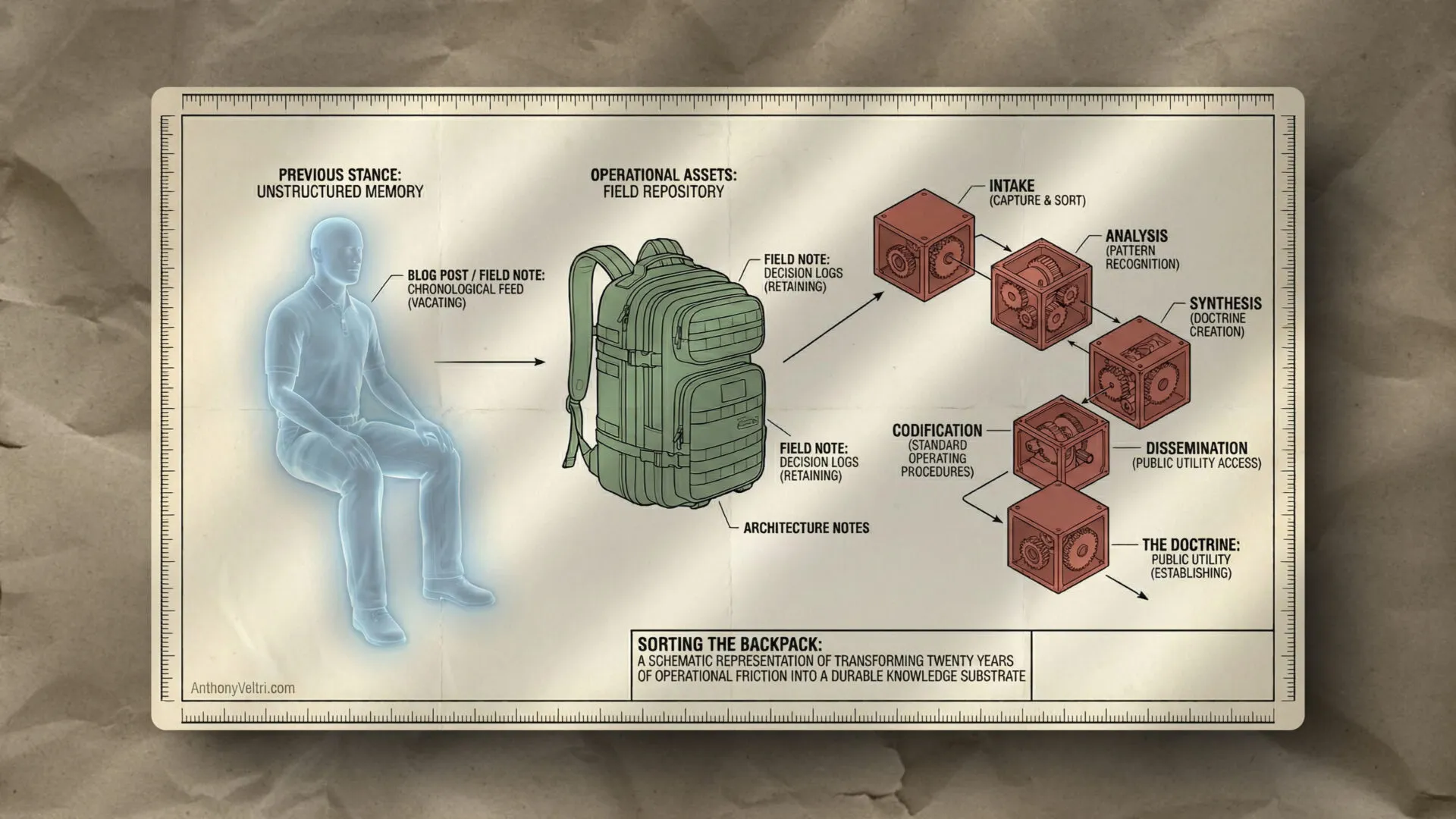

This is personal research, not professional financial advice. I’m a systems architect and mission coordinator, not a financial advisor or economist. But systematic thinking isn’t confined to credential boundaries.

I built this analysis for my own family’s education planning using the same probability modeling, portfolio optimization, and first-principles frameworks I apply to federal coordination problems. Others asked about the methodology, so I documented it systematically.

The analytical approach (Monte Carlo simulations, cumulative distribution functions, Bayesian-style cash flow modeling, portfolio risk management) transfers across domains. The specific calculations are my own situation worked out loud. Your numbers will differ. Your constraints will differ. The framework still applies.

This represents personal writing shared because the systematic methodology proved helpful to others facing similar capital planning decisions. Use what’s useful. Ignore what doesn’t fit. Make your own version.

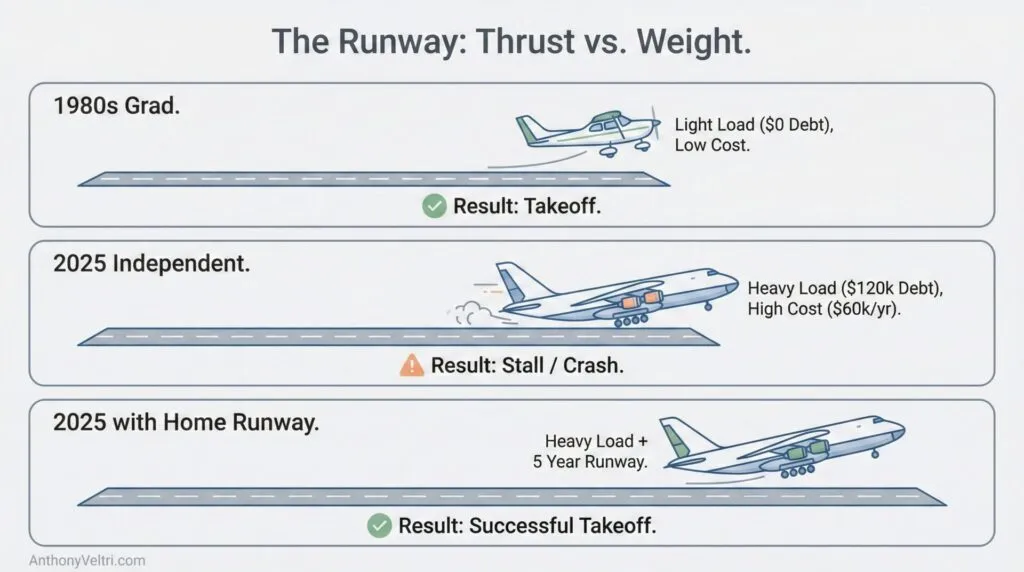

We are sending “Heavy Planes” (high-debt graduates) down “Short Runways” (entry-level wages) and blaming their character when they crash. This briefing outlines the Strategic Defense: A 5-year capital project designed to replace 20 years of interest payments with 5 years of disciplined accumulation. It is not about retreating to a childhood bedroom; it is about building a fortress.

Why This Exists #

I built this analysis for myself. My wife and I have three kids (all aged K-12), and we needed to figure out the actual math on college financing. Not the marketing version (the real cash flow version). We also happen to have Italian citizenship as an option, which opens EU pathways that won’t apply to everyone. But the underlying framework applies regardless of whether you have dual citizenship or not. People can get EU (or alternate) residency through other routes. This isn’t just for dual nationals.

After I worked through the calculations, a colleague asked about it. Then a few more people asked. Then people started asking questions about scenarios I hadn’t modeled for my own family: income-driven repayment plans, what if you can’t provide a home runway, what about high-tax states, what about finance bros making bank, what about the doctor path.

So I added those sections. Some of them don’t apply to my situation specifically, but enough people asked that it was worth documenting the framework for those cases too.

Here’s what this does: Shows you the actual math on college debt, living costs, and payoff timelines using probability distributions instead of marketing slogans.

Here’s why it works: Because it models cash flow month-by-month with realistic shocks (job loss, medical bills, interest capitalization) instead of assuming perfect conditions that never happen.

Here’s the systematic methodology: Bayesian-style Monte Carlo simulations, cumulative distribution functions, landed cost accounting, and portfolio optimization across multiple children.

You can use it or not. But I’ve documented that it’s real, the math checks out, and the strategic levers (home runway, EU paths, geographic arbitrage) have measurable effects on 20-year outcomes.

If you’re facing this decision (whether as a parent planning for kids or a grad drowning in debt), the framework is here. Take what’s useful. Ignore what doesn’t apply. Make your own version.

This is what systematic thinking applied to a $120,000 problem looks like.

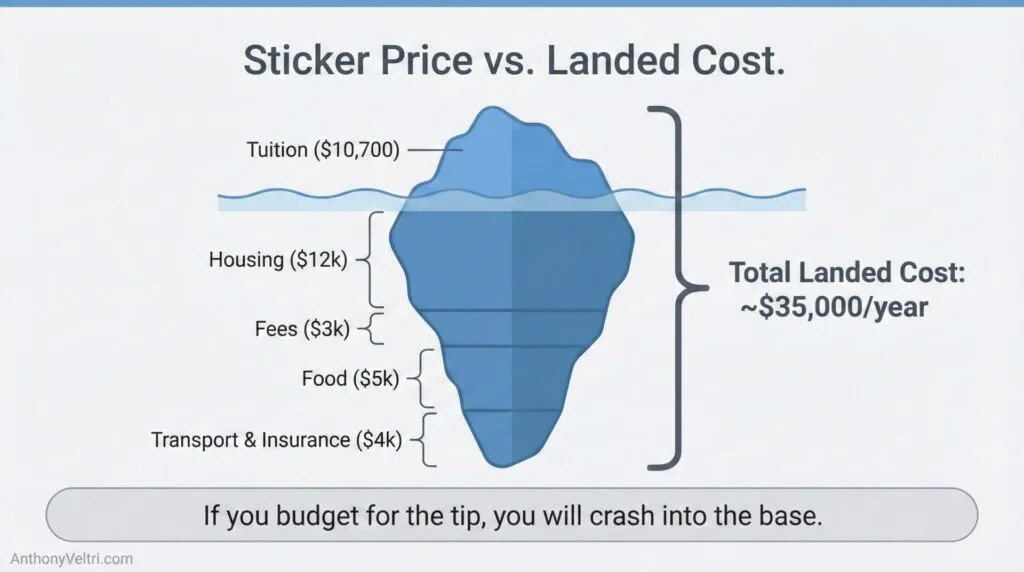

Note: I’m borrowing the term ‘landed cost’ from supply chain management. In business, landed cost means what you actually pay to get a product delivered, not just the invoice price. Same concept applies here: the landed cost of a degree is what a family actually pays to get their kid educated and graduated, not just the tuition headline.

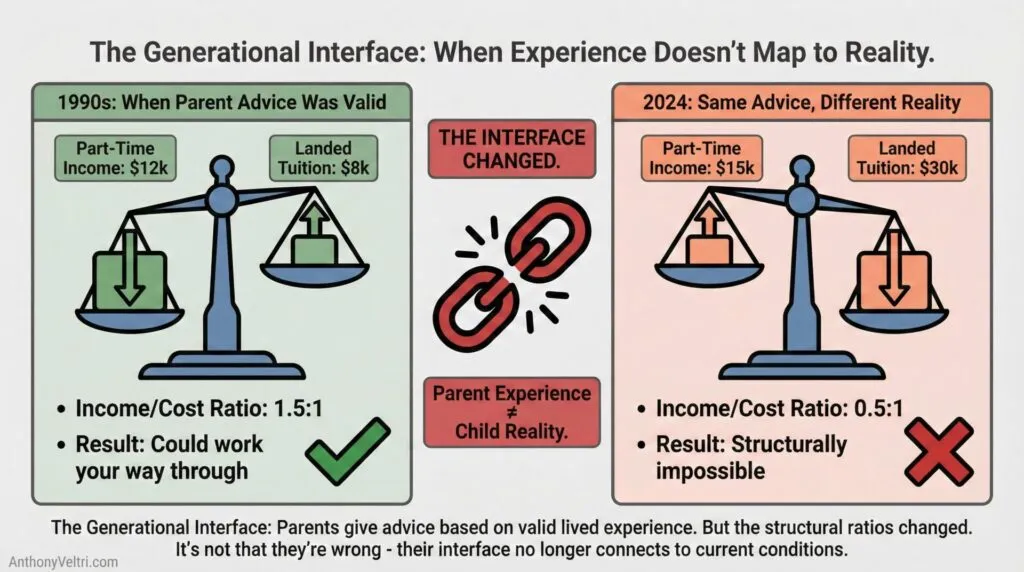

The advice your parents give you is based on a world that no longer exists. Most of them don’t know this yet.

I need to tell you why I built this analysis rather than just repeating the conventional wisdom about college financing.

My undergraduate experience (1990s):

- State university tuition: Low enough to pay with part-time work

- I worked at a unionized supermarket, lived at home, commuted to campus

- Parents helped some, but the tuition + living at home meant I could have covered it entirely with my supermarket salary

- No loans. No debt. Graduated clean.

- This was normal. This was the standard path.

That supermarket job? It was considered a “great union job” by my parents’ generation. Stable employer. Good benefits. The kind of place where even the deli workers and cart pushers wore shirts and ties. (Even in the 90s I thought: “Why am I dressed like this to slice meat and sweep floors? Who does this make feel better?”)

That supermarket chain went out of business during my senior year of high school.

I ended up doing my last year of high school through dual enrollment at the community college. Got credits that transferred to my four-year degree. Found flexibility and cost savings I wouldn’t have had in the standard path.

Then I worked at Eastern Mountain Sports (founded 1967) through undergrad and grad school. Another “stable” employer. Been around for decades. Outdoor retail, solid brand, multiple locations.

Eastern Mountain Sports is now effectively defunct too. Someone bought the name, but the stores that existed in the year 2000 are gone.

Two “stable” employers in a row. Both vanished.

Things Are The Same Until They’re Not #

Here’s what I learned from watching two multi-decade institutions collapse:

Just because something has always been a certain way doesn’t mean it will stay that way. It will be that way right up until the moment it isn’t.

The supermarket had been there my entire life and my parents’ entire life. Then it was gone in months.

Eastern Mountain Sports had been around since 1967. Thirty-plus years of stability. Then it wasn’t there anymore.

If you told my parents in 1990 that both of these employers would be gone, they’d have thought you were paranoid or uninformed. “Those are established businesses. People need to buy food. People need outdoor gear. They’re not going anywhere.”

But structural conditions change. What was stable becomes unstable. What was impossible becomes inevitable.

The Advice That Broke #

My parents gave me advice based on their lived experience:

- “Get a union job at the supermarket, that’s stable”

- “State school is affordable, work your way through”

- “College degree = good job”

All three of these statements were TRUE when they said them. They weren’t lying or uninformed. The world matched their model.

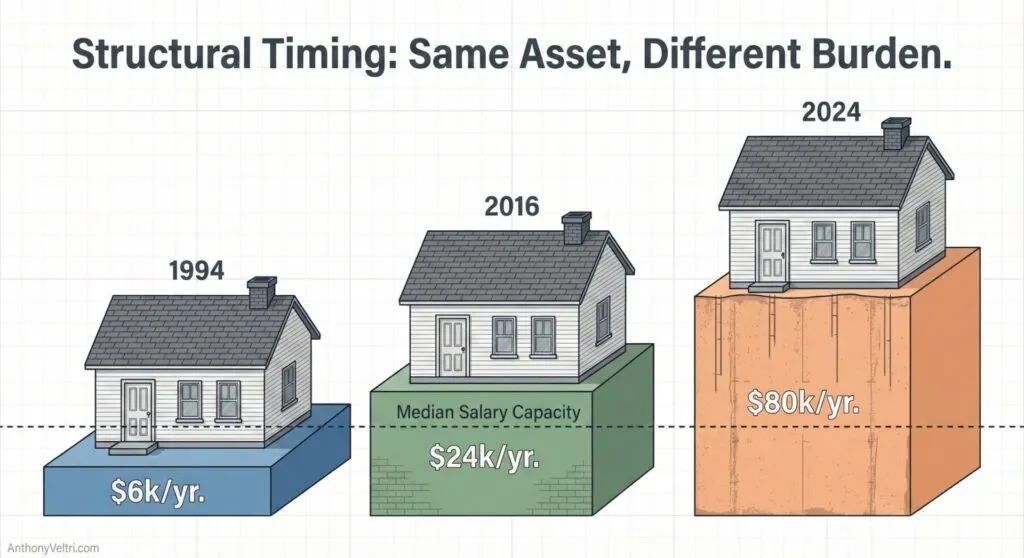

But the world changed:

- The “stable” unionized employer vanished (twice, in my direct experience)

- State school tuition scaled faster than part-time wages (my supermarket salary won’t cover it now)

- College degree stopped guaranteeing solvency (credential inflation broke the interface)

My parents’ generation doesn’t see this clearly because the change happened gradually, then suddenly. They still think their advice is valid because it WAS valid for most of their lives.

But I’m watching my own kids (ages 12, 9, and 5) head into a world where my parents’ advice is not just outdated; it’s dangerous.

Why Conventional Wisdom Is Compromised #

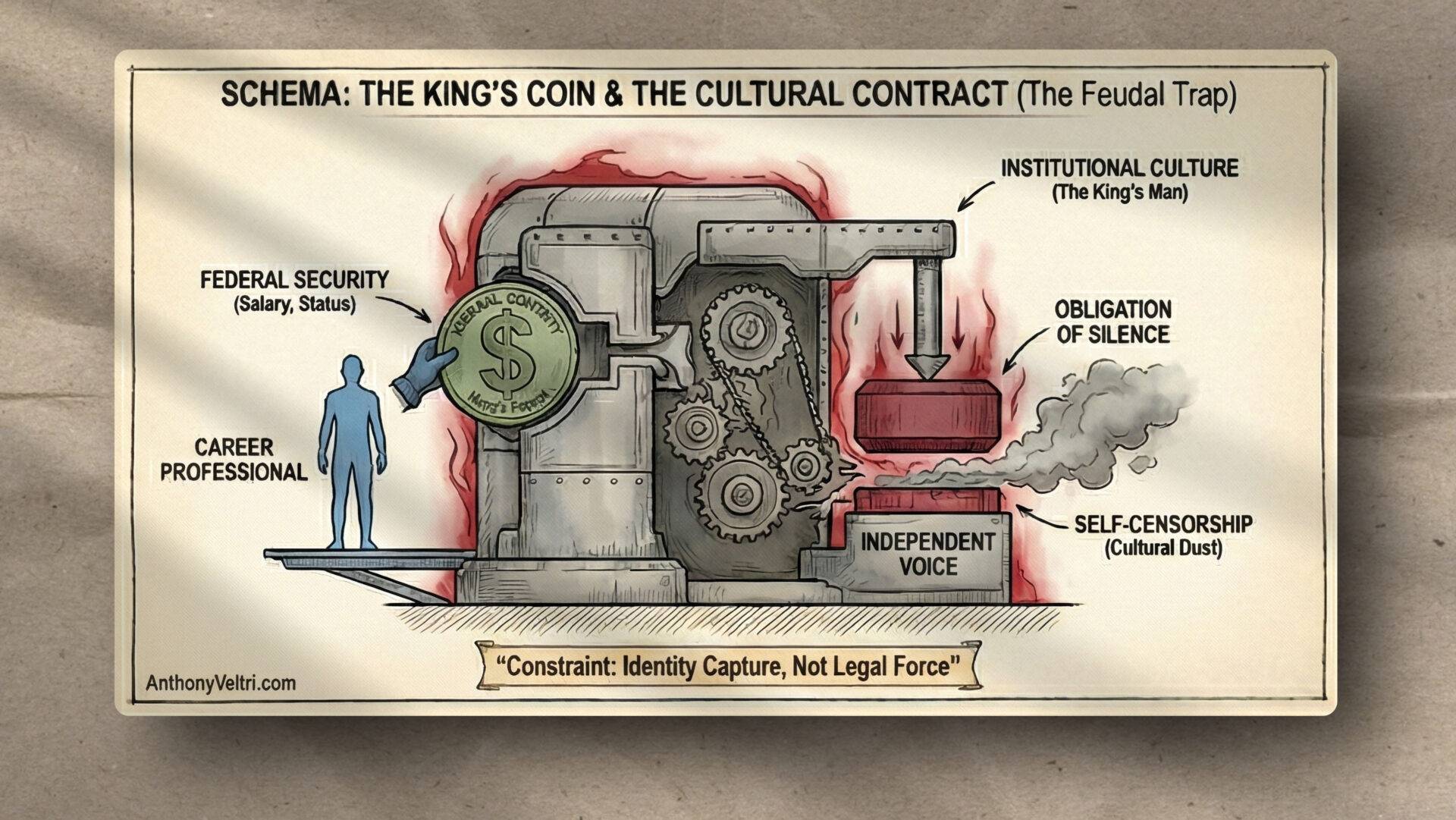

Here’s what I realized: If there’s a popular narrative, it’s really important to ask who benefits from it.

It’s like the tech industry saying: “If you’re getting it for free, you are the product.”

The popular narratives about college:

- “College is always worth it” (Who benefits? Universities collecting tuition)

- “Follow your passion” (Who benefits? Employers who can underpay passionate people)

- “Everyone should go to college” (Who benefits? Loan servicers, universities, credential gatekeepers)

- “Just get a good job and it’ll work out” (Who benefits? People avoiding the math)

These narratives serve someone’s interest. But is it yours?

I couldn’t just trust what “society says” because the zeitgeist probably doesn’t have your best interest in mind. If the narrative is popular and widespread, someone is benefiting from its spread. Follow the incentives.

So I Did The Research #

I couldn’t rely on:

- My parents’ advice (based on 1970s-1990s conditions that no longer exist)

- My own experience (paid for college with part-time job in the 1990s; that’s impossible now)

- Conventional wisdom (compromised by people who benefit from you borrowing)

- University marketing (sticker price vs landed cost, average vs median, winners vs washouts)

So I built the analysis from first principles:

- What does college actually cost? (Landed cost, not sticker price)

- What do graduates actually earn? (BLS data, not marketing slogans)

- What does independent living actually require? (Market rent, not “just be frugal”)

- What happens when you model this month-by-month with realistic shocks? (Probability distributions, not hopes)

This document is what emerged. Not advice based on how things used to be. Not narratives that benefit institutions. Analysis based on current conditions and realistic modeling.

The Pattern I Can’t Unsee #

I’ve now watched:

- The supermarket my parents trusted → gone

- Eastern Mountain Sports I relied on → gone

- DHS systems I built or contributed to → functioning but the institution can’t maintain stable contractor relationships

- “Stable” institutional employment → format mismatch between capability and credentialing

The pattern is: institutions that looked permanent weren’t. Advice that worked for a generation doesn’t. Credentials that signaled capability stopped converting to employment.

I can’t give my kids advice based on “this is how it’s always been” because I’ve personally watched “how it’s always been” vanish multiple times.

So instead I model the system as it exists now. With realistic costs, realistic salaries, realistic shocks, and realistic probability distributions.

When Lived Experience Becomes Structural Fiction

Why This Matters For You #

If you’re a parent: The advice you received probably doesn’t work anymore. Not because you’re wrong, but because the structural conditions changed. You need to educate yourself on current conditions, not just pass down what worked for you.

If you’re a student: The advice your parents give you is based on a world that no longer exists. They mean well. They’re not lying. But their lived experience doesn’t map to your structural reality. You need data, not hope.

I built this because the world changed faster than the conventional wisdom did.

The supermarket was there my whole life and my parents’ whole life. Then it wasn’t.

Eastern Mountain Sports was there for 30+ years. Then it wasn’t.

The structural conditions that made “work your way through college” possible were there for generations. Then they weren’t.

Don’t trust that the old advice still works. Do the math. Model the system. Design for the reality that exists, not the reality that used to exist.

That’s what this document does.

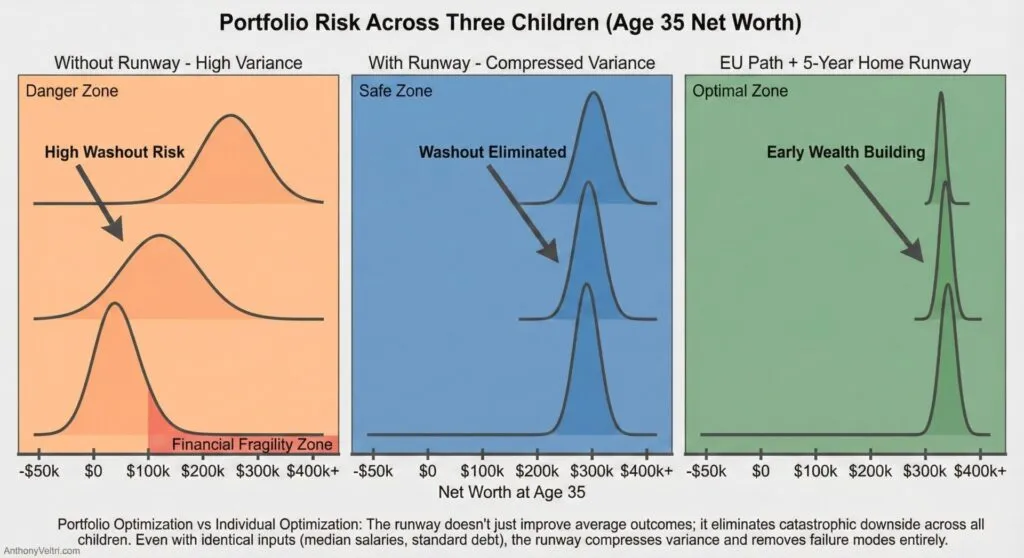

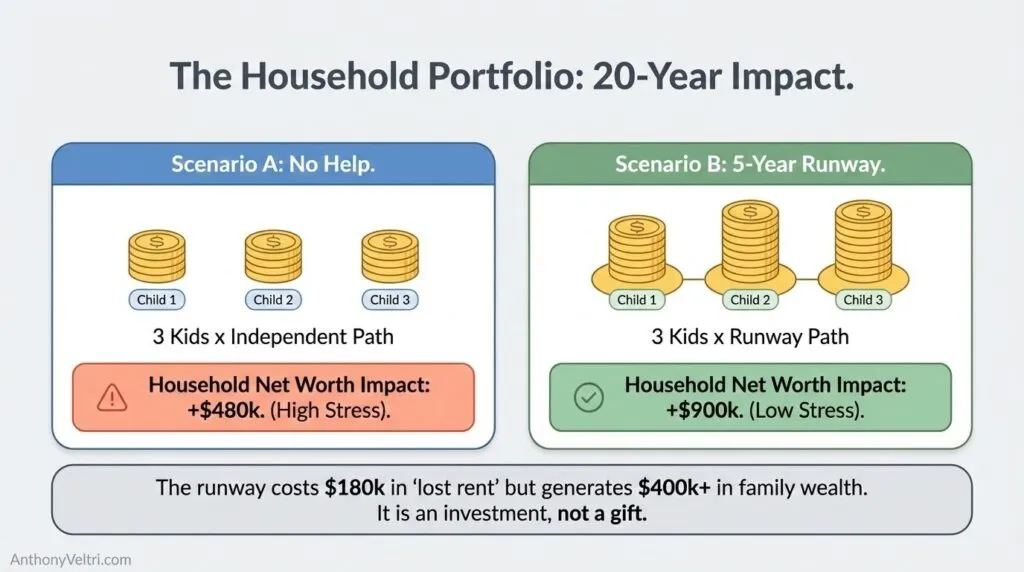

The Portfolio Problem: Optimizing for All Children, Not Just One #

Most college financing analyses optimize for a single child’s success. That’s the wrong problem.

When I ran these calculations, I wasn’t asking “how can I maximize the outcome for my highest-earning child?” I was asking: “What strategy ensures all three of my children achieve financial capability and eliminates the risk of any of them washing out?”

This is portfolio optimization, not local optimization. And the answer was surprising.

The US System Makes Washout Easy, Then Hides It #

Survivorship bias is extreme in American college discourse. We hear constantly about college grads who “made it” (the six-figure earners), the success stories, the people who paid off their loans and bought houses.

We don’t hear about the people who washed out:

- The 20% who never finish paying their loans (permanent forbearance cycles, eventual default)

- The grads working retail with $80k in debt who can’t afford to make payments

- The people who deferred so many times their balance grew larger than their original loan

- The households where one medical crisis or job loss triggered a financial death spiral

The system produces these outcomes regularly. But survivorship bias makes them invisible. The successful grads are vocal and visible. The people who washed out are quiet and ashamed.

As a parent, I couldn’t optimize for the visible outcomes while ignoring the invisible risks.

Three Children, One Framework #

I have three kids (12, 9, and 5 right now). They will have different:

- Academic strengths

- Career interests

- Earning potential

- Tolerance for risk

- Personal circumstances

I can’t know which child will be the “high earner” or which will face the most challenges.

So the optimization problem becomes: What strategy works across all reasonable scenarios and eliminates catastrophic downside regardless of which path each child takes?

Even Scholarships Couldn’t Beat the Runway #

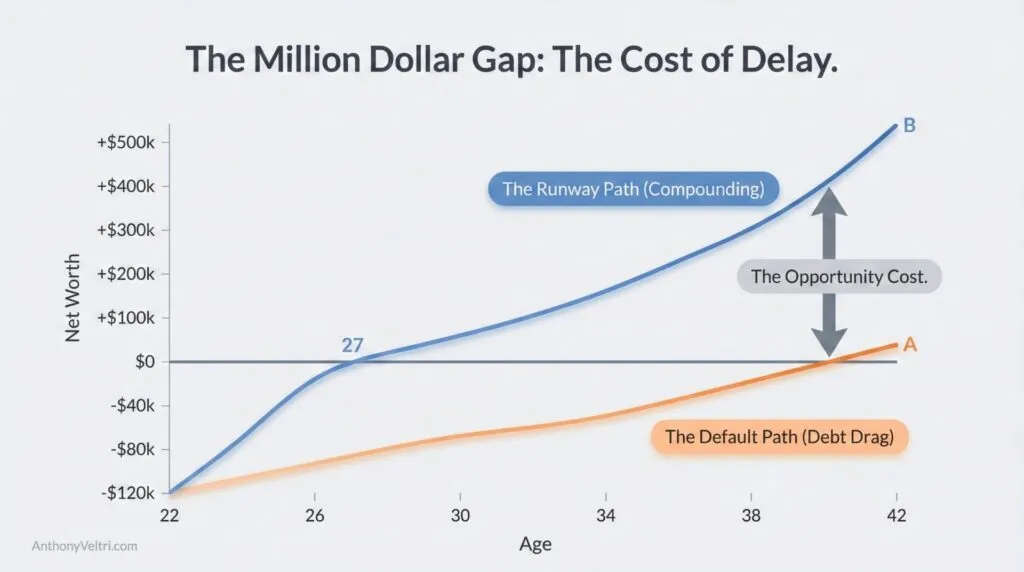

Here’s what surprised me most: Even when I modeled one child getting a full-ride scholarship (zero debt), the 5-year home runway was still the dominant factor in 20-year outcomes.

Why? Because the runway isn’t just about debt elimination. It’s about:

- Eliminating washout risk: Entry-level income volatility + high fixed costs = many graduates can’t achieve solvency even with good jobs. The runway removes this failure mode entirely.

- Building shock resistance: The emergency fund and retirement autopay that get built during the runway years create resilience. One job loss or medical bill doesn’t spiral into crisis.

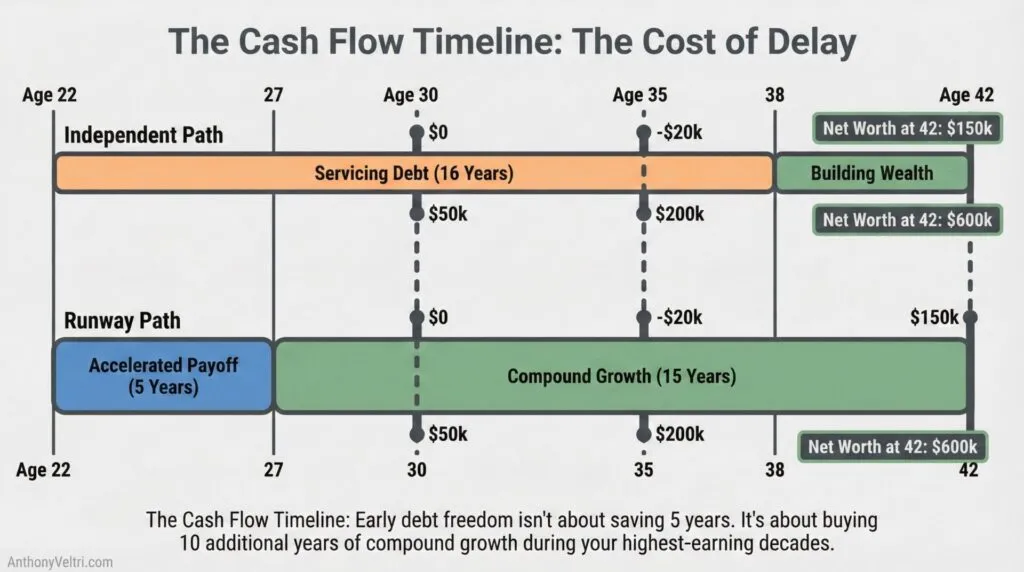

- Enabling early compounding: Being debt-free by 27 (with runway) vs 40 (without) means 13 extra years of compound growth. That’s the difference between $500k and $150k net worth by age 40.

- Preserving optionality: Kids with runway can take career risks, start businesses, accept lower-paying mission-aligned work. Kids servicing debt for 20 years must optimize for cash flow stability above all else.

The runway wasn’t just “better” in my models. It was categorically different. It converted high-variance, high-risk paths into low-variance, low-risk paths.

What This Means for the Analysis #

The framework in this document isn’t about:

- ❌ Maximizing returns for your top performer

- ❌ Gaming financial aid for prestige schools

- ❌ Finding the “optimal” field based on salary data

It’s about:

- ✅ Eliminating catastrophic downside across all three children

- ✅ Ensuring financial capability regardless of which career path each chooses

- ✅ Removing washout risk that survivorship bias hides from view

- ✅ Building household resilience that compounds across generations

The 5-year home runway emerged as the single most powerful lever not because it maximized one child’s outcome, but because it minimized the probability that any child would fail to launch.

That’s portfolio optimization. That’s what this analysis is actually solving for.

The Institutional Gamble: Why Elite Schools Showcase Winners and Hide Underperformers #

I need to be direct about what triggered this entire analysis: watching elite institutions operate like carnival games.

The Carnival Barker Model #

You know the carnival game: “Swing the hammer, ring the bell, win a prize!” The game is designed so that 5% of players ring the bell and win the giant teddy bear, and the other 95% walk away with nothing. The carnival makes money because they showcase the winners and hide the losers.

Elite universities work the same way. They parade John Kerry and George W. Bush around. They tout their billionaire founders and Nobel Prize winners. They don’t talk about the Yale grads working as baristas or the Harvard graduates in default on their loans.

This isn’t an accident. It’s a business model. The institution profits from the gamble. You bear the risk.

Credential Inflation Has Changed Everything #

Here’s what changed: When Bush and Kerry went to Yale, even graduating at the bottom of the class meant something. The credential itself had value. You were “a Yale man.”

That’s no longer true. Now you have top-of-class Brown University graduates working as baristas. Harvard degree? Maybe. Maybe not. The credential alone doesn’t guarantee outcomes anymore. Note: These aren’t ‘failures’ in the personal sense. They’re format mismatches between credential signals and market reality. The barista with a Brown degree isn’t less capable than the Bush-era Yale grad who became a senator. The interface between credential and compensation changed, but the landed cost didn’t adjust. You’re paying 2024 prices for a 1980s contract that no longer exists.

But the price hasn’t adjusted. The landed cost keeps rising while the floor on outcomes keeps dropping. You’re paying 2024 prices for what used to be a 1980s guarantee but is now a lottery ticket.

High-Risk Paths Are Especially Pernicious #

The doctor path and the finance bro path look like “sure things” from the outside. High income! Prestigious career! But both require you to complete the entire sequence without stumbling.

Doctor path:

- 4 years undergrad → 4 years med school → 3-7 years residency → must get license

- If you wash out at ANY point: You have the debt but not the credential

- Burn out in year 6 of med school? You’re $200k+ in debt with no medical degree

- Fail to match for residency? Same problem

- The sequence is load-bearing. You must complete every stage or you’re underwater with nothing to show for it.

Finance bro path:

- Must get into target school → must get summer internship → must convert to full-time → must survive first 2 years

- High income ($110k+) but expenses scale with income location (NYC rent, lifestyle expectations, peer pressure)

- If you wash out: You have expensive tastes and no income to support them

- Get laid off? You’re paying $3,500/month rent on unemployment

- Tight coupling means zero slack. $110k income with $100k annual expenses means ANY interruption is catastrophic.

These paths are advertised as “low risk” because of the eventual high income. That’s survivor bias talking. The people who washed out aren’t at the alumni events.

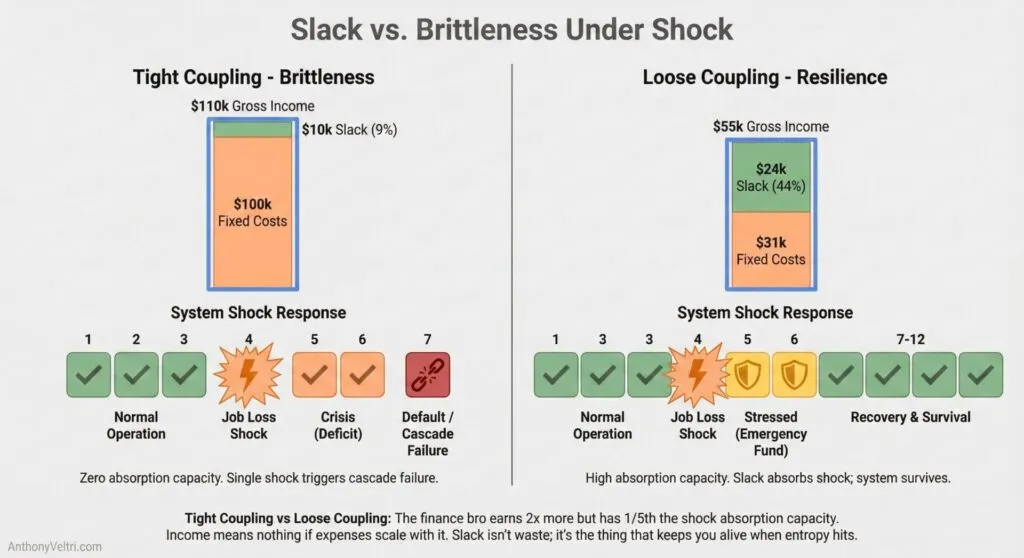

Entropy Is Not Optional #

Here’s the hard truth: Over a 40-year career, you WILL face major shocks. It’s not “if,” it’s “when” and “how many.”

Inevitable shocks include:

- 3-5 job losses or major employment disruptions (layoffs, company closures, industry shifts)

- 1-3 major medical events (accidents, surgeries, chronic conditions that flare)

- Family emergencies (parent needs care, sibling in crisis, relationship dissolution)

- Economic shocks (recessions, industry collapses, credential obsolescence)

The question isn’t whether you’ll face entropy. The question is whether your financial structure can absorb it.

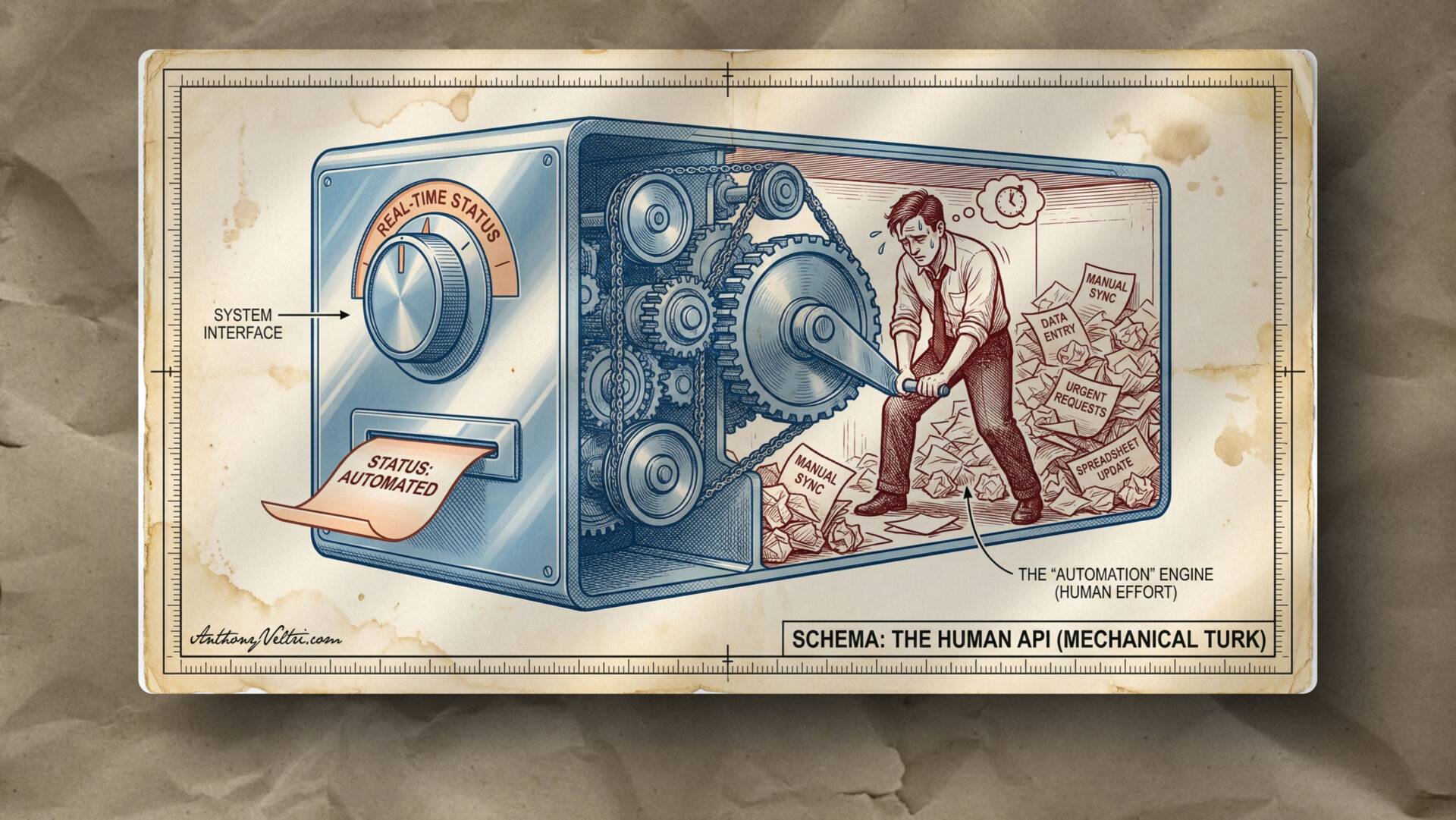

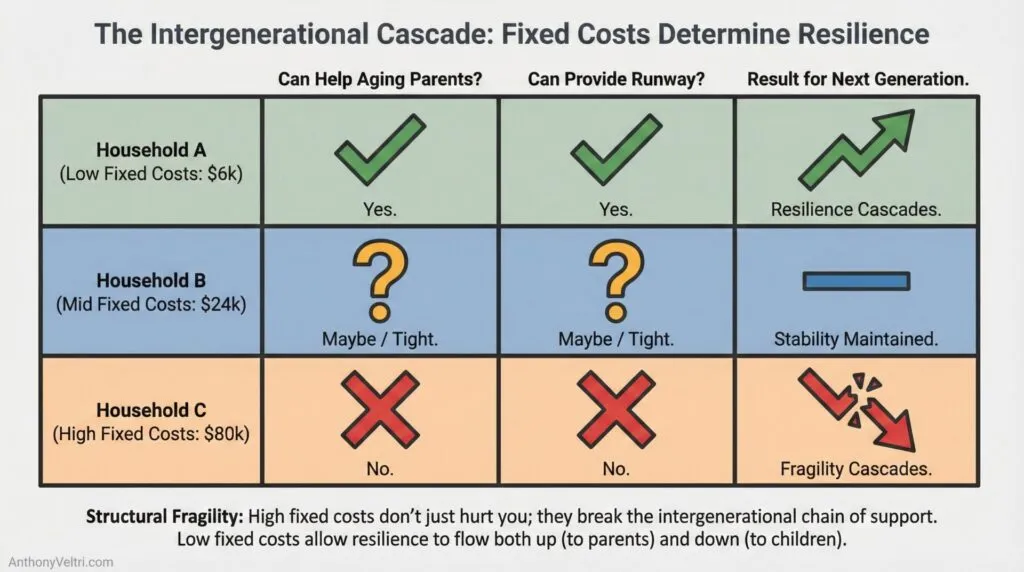

Tight Coupling Is Brittleness at Any Income Level #

This connects to my core operating principle: “Stiff means brittle. Loose means resilient.”

Stop Designing Brittle Lives: The Case for Loose Coupling:

The new grad finance bro earning $110k in NYC looks successful:

- High income! Prestigious job! Career track!

But examine the coupling:

- Income: $110k gross → ~$75k net after taxes

- Fixed costs: $70k-$80k (rent, loans, minimum lifestyle for the job)

- Slack: $0-$5k/year

- Any interruption (job loss, health crisis, family emergency) immediately catastrophic

Compare to median earner on home runway:

- Income: $55k gross → ~$41k net

- Fixed costs: $31k (token + loan)

- Slack: $10k/year

- Interruptions are survivable. System has absorption capacity.

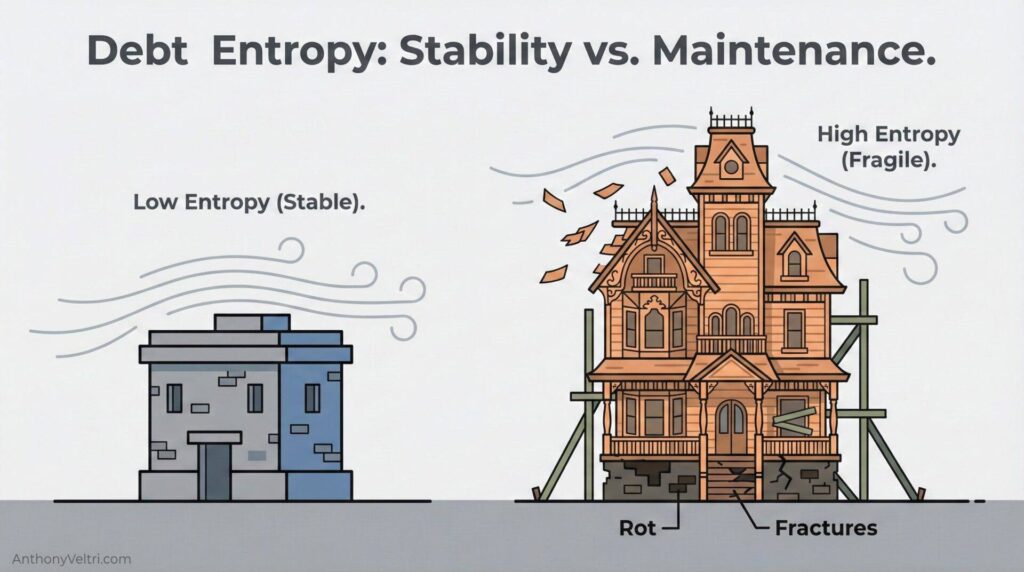

The finance bro is like a wooden house in a humid climate. Looks impressive, requires constant maintenance (high cash flow), collapses quickly when conditions change. High entropy, high fragility.

The runway grad is like a stone house in a dry climate. Less impressive initially, requires minimal maintenance (low cash flow), survives shocks by design. Low entropy, high resilience.

This is thermodynamics, not just budgeting. Systems under high tension fail catastrophically when shocked. Systems with slack absorb and adapt.

Why I Built the Analysis This Way #

When I looked at college financing advice, I saw:

- ❌ Schools showcasing winners, hiding losers (carnival barker model)

- ❌ High-risk paths sold as “sure things” (survivorship bias)

- ❌ Tight-coupling strategies praised as “success” (finance bro lifestyle)

- ❌ No accounting for inevitable entropy (shocks are treated as “if” not “when”)

- ❌ Individual optimization, ignoring portfolio risk (one kid succeeds, two wash out)

So I built an analysis that:

- ✅ Models the full probability distribution, not just the winners

- ✅ Accounts for inevitable shocks over 20-year timelines

- ✅ Optimizes for downside elimination across all children

- ✅ Prioritizes slack and resilience over maximum income

- ✅ Treats tight coupling as the vulnerability it is

The 5-year home runway kept emerging as dominant not because it maximized income, but because it built slack into the system. It converted high-entropy, brittle paths into low-entropy, resilient paths.

That’s not about being conservative or risk-averse. It’s about understanding that entropy is inevitable and designing for survival, not just for optimal conditions.

The carnival barker wants you to focus on the giant teddy bear. I’m telling you to notice that 95% of people walk away with nothing and plan accordingly.

These Aren’t “Failures” – They’re Format Mismatches #

Let me reframe something important: The Harvard grad working as a barista didn’t “fail.” They’re experiencing a format mismatch between credential signals and market reality.

Format mismatch means:

- The credential format (Harvard degree) was designed to signal capability in a specific market context (1990s-2000s hiring)

- That market context changed (credential inflation, skill requirements shifted, geographic constraints, timing effects)

- The person’s capability didn’t decrease. The interface between credential and compensation broke.

This is the same pattern I see in systems architecture: When the interface specification changes but both sides expect the old contract, you get systematic failures. It’s not a personal failure. It’s an interface ownership problem.

The barista with a Brown degree isn’t less capable than the Bush-era Yale grad who became a senator. Different structural conditions. Different interface specifications. Different outcomes.

But here’s the pernicious part: The landed cost didn’t adjust when the interface broke. You’re paying 2024 prices for a 1980s contract that no longer exists. The institution still charges as if the old interface works, but they’re not on the hook when it doesn’t.

You bear the downside of the format mismatch. They keep the tuition regardless of whether the credential converts to income.

This is why I built the analysis to eliminate washout risk rather than maximize upside. Because in a world of format mismatches and broken interfaces, the most important thing is not ending up with six-figure debt and a credential that doesn’t convert to cash flow.

The runway doesn’t prevent format mismatches. But it ensures you’re not financially destroyed when they happen. You can weather a format mismatch at age 27 with no debt. You cannot weather it at age 35 with $80k remaining loan balance.

This Is Systems Architecture Applied to a Capital Project #

I need to be clear about what this document is and isn’t.

This is not financial advice. I’m not a financial advisor, and I’m not telling you what to do with your money. What this IS is systems architecture applied to a capital project – that’s my background, so that’s the lens I used.

This is systems architecture. I’m documenting the load-bearing structures that enable a system (a young adult’s financial life) to function under realistic operating conditions.

The Architectural Framing #

The runway isn’t a “money hack.” It’s designing the load-bearing structure that enables the system to survive entropy. Without it, the system (independent living + median salary + six-figure debt) is structurally unsound. It will collapse under normal operating stress.

The written agreement isn’t bureaucracy. It’s the interface specification between two systems (parent household and child household). Verbal agreements are high-entropy interfaces. Written agreements are low-entropy interfaces. If you want the system to survive, document the interface.

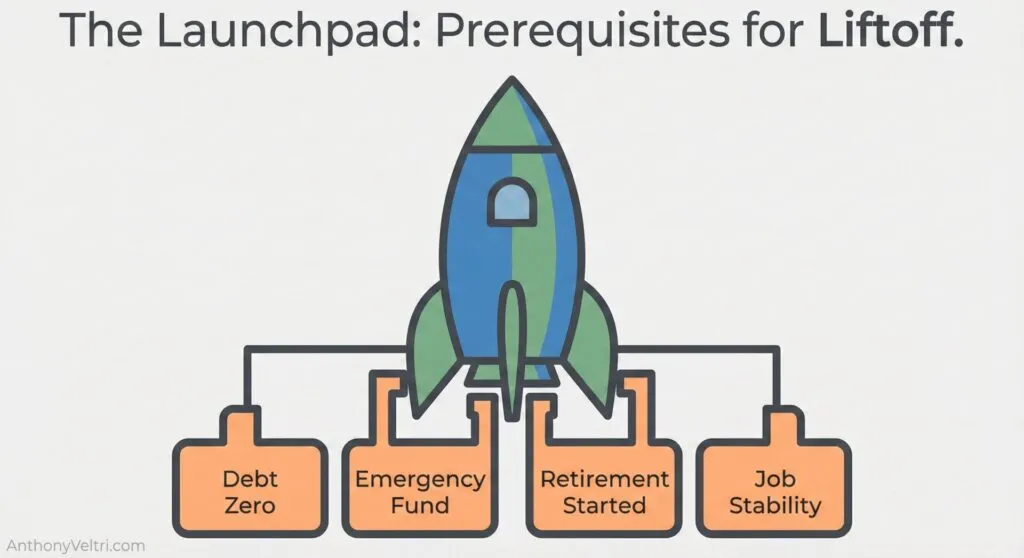

The exit milestones aren’t arbitrary targets. They’re structural requirements for system launch:

- Debt at zero = removing the drag coefficient

- Emergency fund = installing the shock absorber

- Retirement autopay = enabling compounding

- Job stability = verifying thrust capacity

You can’t launch a plane that’s still chained to the ground. You can’t launch a young adult who’s structurally insolvent.

Entropy isn’t bad luck. It’s thermodynamic reality. Every system faces increasing disorder over time. You either design for it (build slack, create shock absorption, maintain loose coupling) or you fail catastrophically when it hits.

Tight coupling isn’t “efficiency.” It’s brittleness. A system operating at 95% capacity with zero slack will fail when any component varies even slightly. This is true for computer systems, aircraft systems, and personal finance systems.

What I’m Actually Doing Here #

I’m not giving advice. I’m documenting the architectural requirements that emerged from modeling realistic conditions:

- Median starting salary: $55k (BLS data)

- Landed cost of degree: $25k-$35k/year (actual costs, not marketing)

- Standard loan repayment: $1,330/month (math, not hope)

- Independent living cost: $60k/year (market rates in job centers)

- Probability of shocks over 20 years: ~100% (employment, health, family)

When you model these together with realistic probability distributions, the default path fails for most people. Not because they’re bad with money. Because the math doesn’t work.

The runway emerged as the single most powerful intervention because it changes the structural equation. It doesn’t just “help a little.” It converts an impossible equation into a solvable one.

This isn’t about being conservative or risk-averse. It’s about understanding load-bearing requirements and designing accordingly.

If you’re an architect and someone asks you to design a bridge, you don’t optimize for “looks impressive” or “uses least material.” You optimize for “doesn’t collapse when loaded.”

That’s what this analysis does. It identifies the load-bearing requirements for financial launch and documents what happens when you meet them vs when you don’t.

Use it or don’t. But I’ve documented that it’s real, the math is sound, and the structural requirements are what they are regardless of whether we like them.

Executive Summary #

College can be valuable, but the landed cost plus early career earnings shortfall make the default U.S. path financially fragile unless you either remove loan drag entirely (EU/public low-cost options) or change the cash flow equation with a 3–5 year home runway. The decisive factor is not sticker price or lifetime earnings slogans, but early cash flow solvency.

Key Takeaways #

The 5-year home runway is the single most powerful lever. It cuts living costs from ~$60k/year to ~$15k and turns impossible loan math into solvency. Not everyone can provide this (requires parental resources and relationship quality), but if you can, the math is overwhelming.

EU paths are not truly zero cost, but their modest debt loads behave like stone houses in dry climates: low maintenance, long-lasting, much harder to collapse. U.S. graduates with six-figure loans face wooden-house-in-humidity conditions: high entropy, constant upkeep, easy to fall behind.

Median salaries are not enough to guarantee solvency. Tail risk (job shocks, health costs, pauses) pushes payoff toward 15-20 years without intervention. The advertised 10-year timeline assumes perfect conditions that don’t exist.

Geographic and policy variations matter. State tax rates (0-8%), remote work availability, and family capacity to provide runway all affect outcomes significantly. A $55k salary means completely different things in Texas (no state tax) vs California (8% state tax) vs living at home (minimal costs).

Core Question We’re Answering #

How much income does a new graduate really need to live and service loans?

And more importantly: What structural changes (runway, location, debt elimination) actually create solvency rather than just postponing crisis?

Most advice says “get a good job and it’ll work out.” That’s not analysis. That’s hope. This is analysis.

Critical Definitions #

Sticker Price vs Landed Cost #

Sticker price: The tuition and basic fees schools advertise in headlines. “Only $10,700/year for in-state public!”

Landed cost: What a family actually pays to walk in the door. For college this includes:

- Tuition

- Mandatory fees (technology, health, activity, lab fees)

- Room and board (on or off campus)

- Books and supplies ($1,000-$1,500/year, even with “used” books)

- Required add-ons (health insurance if not covered by parents, parking permits)

- Transport (getting to/from campus)

- Realistic incidentals (because 18-year-olds need more than instant ramen)

Example:

- Public university sticker: $10,700/year

- Actual landed cost: $25,000-$35,000/year (2-3x the headline)

Why this matters: Cash flow and debt are determined by landed cost, not the marketed price. Plans built on sticker price will fail when reality hits. You can’t budget $10,700 when you actually need $30,000.

Median vs Tails #

Median: The middle outcome. Half finish better, half finish worse. If 100 people pay off loans, the 50th person’s timeline is the median.

Tails: The bad years or rare sequences that create big setbacks. Job loss for 3 months. $8,000 emergency room visit. Car totaled during a lean year. These aren’t median. They’re the outliers that destroy plans.

Why this matters: Real life is not just an average. Plans must account for realistic bad scenarios, not just hoped-for good ones. If your plan only works under perfect conditions, it’s not a plan; it’s a wish.

CDF (Cumulative Distribution Function) #

A CDF curve shows, for any point on the x-axis, the percentage of outcomes that finish by that point.

Example: Looking at loan payoff times:

- At 12 years: CDF = 0.65 means 65% of simulated paths finished their loans by year 12

- The other 35% are still paying

- This shows you the distribution: best case, median, worst case

Why this matters: Shows the whole probability landscape, not just one optimistic number. “Most people pay off in 10 years” hides the 40% who don’t.

Bayesian-Style Repayment Modeling (more on this here) #

We simulate month by month. If a graduate cannot afford the standard payment in a given month, they sometimes pay little or nothing, and interest can accrue or capitalize. This creates realistic long payback times instead of assuming a clean 10-year payoff.

We model:

- Income volatility (raises, job changes, unemployment spells)

- Emergency expenses (medical, car, family)

- Payment decisions under stress (defer? Pay minimum? Pay standard?)

- Interest accrual when payments don’t cover interest

- Capitalization events (when unpaid interest gets added to principal)

Why this matters: Advertised payoff timelines assume perfect conditions: steady income, no emergencies, disciplined payments. Real outcomes drift toward 15-20 years for many borrowers because life happens.

The Core Math: All Scenarios in One Place #

This section contains all the detailed calculations. The rest of the document references back here. Read this once carefully, then the later sections will make sense.

Baseline Assumptions #

Loan: $120,000 at 6% interest, standard 10-year repayment plan

- Monthly payment: $1,330

- Annual payment: $15,960 (round to $16,000)

- Total interest over 10 years: ~$40,000

- Total repaid: $160,000

Living costs:

- City (independent): $60,000/year baseline

- Rent: $1,500-$2,000/month ($18k-$24k/year)

- Food: $400-$600/month ($5k-$7k/year)

- Transport: $200-$400/month ($2.4k-$5k/year)

- Utilities/internet: $150-$250/month ($2k-$3k/year)

- Healthcare (premiums + out-of-pocket): $3k-$5k/year

- Everything else: $10k-$15k/year

- Cities vary: NYC/SF/Boston = $75k+, second-tier cities = $50k-$65k, using $60k as representative

- At-home (token contribution): $15,000/year

- Can be cash, defined labor, or mix

- Represents fair contribution to household without market-rate rent

- Range: $12k-$18k depending on family situation

Tax assumptions:

- Low/median earners (<$60k): 25% effective federal

- Higher earners ($60k-$100k): 27% effective federal

- Add state tax where applicable:

- High-tax states (CA, NY, MA, NJ): +5-8% state tax

- Zero-tax states (TX, FL, WA): 0% state tax

- Middle states: +3-5% state tax

Starter salaries tested:

- Low: $40,000 (median for humanities, social services, education)

- Median: $55,000 (median across all fields)

- High: $80,000 (engineering, computer science, finance entry level)

- Elite: $110,000+ (top-tier finance/consulting, FAANG tech, quant roles)

EU variant:

- No loan or token $10k-$20k (EU tuition is €0-€3k/year in many countries)

- 10-15% starting salary haircut for first 2-3 years while U.S. networks and credential recognition build

- Then converges to peer salary by year 4-5

- Example: EU grad starts at $50k while U.S. peer starts at $55k, both at $70k by year 5

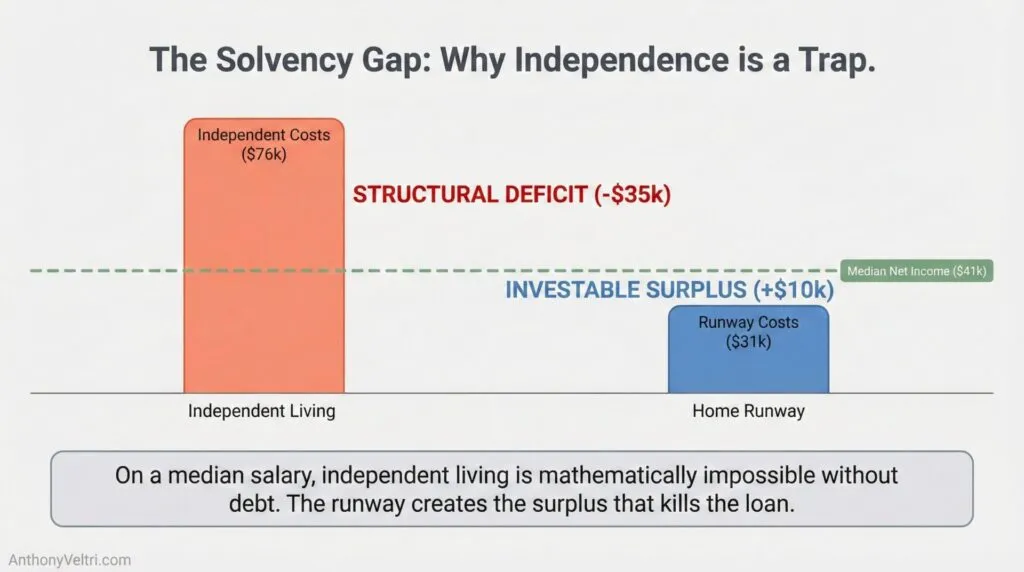

Scenario 1: Independent in City with $120k Loan #

Annual costs:

- Living: $60,000

- Loan payment: $16,000

- Total net needed: $76,000

Gross income required:

- At 25% tax rate: $76,000 ÷ 0.75 = $101,333 gross

- At 30% tax rate (high-tax state): $76,000 ÷ 0.70 = $108,571 gross

Reality check:

- Median starting salary: $55,000

- Gap to solvency: $46,000 to $54,000 short

- Result: Cannot achieve solvency. Savings does not start. Loan payments often deferred or minimized, extending payoff toward 15-20 years.

What happens in practice:

- Graduate defers payments during job search

- Takes income-driven repayment (lower monthly, longer timeline)

- Pays minimums, principal barely decreases

- Interest capitalizes during deferrals

- Ends up paying for 20+ years, total cost $180k-$220k

Scenario 2: Living at Home with $120k Loan #

Annual costs:

- Token living: $15,000

- Loan payment: $16,000

- Total net needed: $31,000

Gross income required:

- At 25% tax rate: $31,000 ÷ 0.75 = $41,333 gross

- At 30% tax rate: $31,000 ÷ 0.70 = $44,286 gross

Reality check:

- Even low earner at $40,000 is close (might need $12k token instead of $15k)

- Median earner at $55,000: Net income $41,250, after costs have $10,250 annual surplus

- Result: Solvency is achievable. Surplus can attack principal aggressively.

The Trap: Most graduates mistake insolvency for independence.

The Math of Insolvency: On a median salary (Green Line), independent living creates a massive structural deficit (Red Bar). The Runway creates the surplus (Blue Bar) that kills the loan.

What changes:

- Standard payment is manageable

- Surplus can go to extra principal

- No deferrals needed, no interest capitalization

- Emergency fund can build

- Path to debt-free in 5-6 years is realistic

Scenario 3: Aggressive Payoff with Home Runway #

Target: Pay off $120k in 4.7 years

Required annual loan payment: ~$29,500

- This is nearly double the standard payment

- Goes almost entirely to principal after year 1

- Cuts total interest from $40k to $18k-$25k

With $15k token living cost:

- Total net needed: $44,500

- Gross needed (25% tax): $59,333

- Gross needed (30% tax): $63,571

Doing same while living independently:

- Total net needed: $89,500 ($60k living + $29.5k loan)

- Gross needed (25% tax): $119,333

- Gross needed (30% tax): $127,857

The runway effect: Roughly halves the income requirement to hit aggressive payoff target.

A median earner can do it with the runway. Would need to be a high earner (top 10-15% of grads) to do it without runway.

Scenario 4: Median Earner at $55k – Two Paths #

Path A: Living at home

- Gross: $55,000

- Net income (25% tax): $41,250

- After token + standard loan: $41,250 – $31,000 = $10,250 surplus/year

- Directing 100% of surplus to principal: Payoff in approximately 5.3 years

- Saves about 4.7 years vs the 10-year schedule

- Total interest paid: ~$19,000 (vs $40,000 standard)

Path B: Living independently

- Gross: $55,000

- Net income: $41,250

- After living + loan: $41,250 – $76,000 = -$34,750 annual deficit

- Cannot make standard payments consistently

- Forced into income-driven repayment or deferrals

- Payoff drifts toward 15-20 years

- Total interest paid: ~$80,000-$120,000

- Difference: $60,000-$100,000 more in interest, 10-15 years longer timeline

This is the same person, same job, same income. The only difference is living arrangement for 5 years.

Scenario 5: Low Earner at $40k with Adjustments #

Option A: Lighter token ($12k instead of $15k)

- Net needed: $28,000

- At $40k gross (25% tax): Net = $30,000

- Surplus: $2,000/year

- Payoff: approximately 8.5 years

- Still better than 15-20 years independent

Option B: Token $15k + $5k net side income

- Total net income: $35,000 ($30k from job + $5k side)

- Net needed: $31,000

- Surplus: $4,000/year

- Payoff: approximately 7.5 years

Result: Even low earners can achieve reasonable payoff with runway, especially with modest side income or lighter token contribution. The runway makes the mathematically impossible become achievable.

Scenario 6: Finance Bro / High Earner Path ($110k+) #

The pitch: “Just get a high-paying job and debt doesn’t matter.”

Reality check:

Living in NYC (required for most finance roles):

- Gross: $110,000

- Effective tax: 30-32% (federal + NY state + NYC)

- Net: ~$75,000

- NYC living cost (studio in Manhattan/Brooklyn): $70,000-$80,000/year

- Rent: $3,000-$3,500/month

- Everything else scales with location

- Loan payment: $16,000

- Total needed: $86,000-$96,000

- Surplus: -$11,000 to -$21,000 deficit OR barely breaking even

Even at $110k, you can struggle in high-cost cities. The salary sounds huge. The cost structure eats it.

Path to solvency for finance bro:

- Live with 3 roommates (cut rent to $1,500/month)

- Actually achieves surplus

- Can pay off in 6-8 years

- But: This is a top 5% salary requiring specific pedigree (target school, internships, connections)

Bottom line: High salaries help, but they’re not a universal solution. Most grads don’t get $110k offers. And even those who do face scaled costs. The runway still matters even for high earners if they want to be debt-free fast.

Scenario 7: Doctor / High Debt, High Pay Path #

The unique calculation:

Medical school debt:

- Undergrad: $120,000 (our baseline)

- Med school: $200,000-$300,000

- Total debt: $320,000-$420,000

Residency years (3-7 years depending on specialty):

- Income: $55,000-$65,000

- Cannot meaningfully pay down debt

- Interest accrues: at 6%, that’s $19,200-$25,200/year just in interest

- Debt grows during residency

Post-residency (attending physician):

- Income: $200,000-$500,000+ depending on specialty

- Finally have surplus

- But: By now, debt has grown to $450,000-$550,000 from capitalized interest

Payoff timeline:

- Even at $300k income, aggressive payoff takes 5-7 years

- Total time: 4 years undergrad + 4 years med school + 4 years residency + 5 years payoff = 17 years from starting college to debt-free

- Age 35-40 before wealth building can really start

Is it worth it?

- Lifetime earnings for doctors are very high

- But: Delayed gratification is extreme

- Alternative: EU medical school (much cheaper) then practice in US

- Or: Specialize in high-paying fields (derm, ortho, cards) rather than primary care

The runway for doctors:

- Doesn’t help during school (you’re not living at home during med school/residency)

- Could help during undergrad (save that $120k, reduces total debt by ~25%)

- Could help during residency (live cheaply, minimize lifestyle creep)

Bottom line: Medicine is high-risk, high-reward with extreme delayed payoff. Works if you’re committed. Fails catastrophically if you burn out in year 6. The debt load and timeline mean you need to be very sure.

Summary Table: Gross Income Required #

| Scenario | Living Situation | Loan Strategy | Gross Income Needed (25% tax) | Gross Income Needed (30% tax) | Notes |

| Standard payments | Independent city | 10-year plan | $101,333 | $108,571 | Most grads can’t hit this |

| Standard payments | At-home token | 10-year plan | $41,333 | $44,286 | Achievable for median earners |

| Aggressive payoff | Independent city | 4.7 years | $119,333 | $127,857 | Requires top 10% salary |

| Aggressive payoff | At-home token | 4.7 years | $59,333 | $63,571 | Achievable for median+ earners |

| Finance bro (NYC) | Independent NYC | 10-year plan | $115,000+ | $120,000+ | High salary eaten by NYC costs |

| With roommates | Shared housing | 10-year plan | $75,000-$85,000 | $80,000-$90,000 | More realistic than solo |

Key insight: The home runway doesn’t just make payoff “a little easier.” It makes impossible math possible and aggressive payoff achievable on median salaries.

Without runway: Need to be top 5-10% of earners to achieve solvency in a city.

With runway: Median earners can kill debt in 5-6 years and start wealth building.

You cannot lift a heavy debt with a short lever. The runway provides the mechanical advantage required to move the load.

Geographic Variation: State Taxes Matter

The baseline calculations use 25-30% effective tax rates. Reality varies significantly by state. This isn’t a minor detail; it’s thousands of dollars per year.

High-Tax States (Add 5-8% to Federal) #

California, New York, New Jersey, Massachusetts, Oregon, Minnesota, DC:

- State income tax: 5-8%

- Combined effective rate: 30-35%

- Impact: Makes independent city living even more impossible

- Also: These states have highest cost-of-living cities

Example: NYC/SF resident making $101k (the “required” income for independent solvency)

- Federal + state + local tax: ~32%

- Net income: $68,680

- After $60k living + $16k loan: **-$7,320 deficit**

- Even at the calculated “required” income level, still underwater

The math doesn’t work without adjustment:

- Need $115k+ gross just to break even

- Or: Use runway to bypass the problem entirely

Zero-Tax States #

Texas, Florida, Washington, New Hampshire, Nevada, Tennessee, Wyoming, South Dakota:

- State income tax: 0%

- Combined effective rate: 25-27% (federal only)

- Impact: Helps, but doesn’t solve the fundamental cash flow problem if living costs are still $60k

Why it’s not a magic bullet:

- Major Texas cities (Austin, Dallas) have high housing costs anyway

- Florida cities (Miami, Tampa) same issue

- You save 5-8% on taxes, but that’s $2,750-$4,400/year on a $55k salary

- Helpful, but doesn’t close a $35k annual deficit

Where it helps most:

- Combined with lower cost of living (Houston, San Antonio, Tampa suburbs)

- Remote work (earn SF salary, live in Texas)

- See Remote Work section below

Middle Ground States #

Most other states: 3-5% state tax

- Combined effective rate: 28-32%

- Not as brutal as CA/NY, not as advantageous as TX/FL

- Still need to account for it in calculations

What This Means #

The runway effect is even more powerful in high-tax states.

Cutting living costs from $60k to $15k matters more when you’re losing 30-35% to taxes instead of 25%. Every dollar of surplus is worth more when your take-home rate is lower.

Remote work changes this equation dramatically (see below), but for traditional office jobs, high-tax states make solvency harder to achieve.

Planning takeaway: Don’t just look at salary. Look at salary minus taxes minus living costs. Two jobs with the same gross pay can have wildly different financial outcomes based on location.

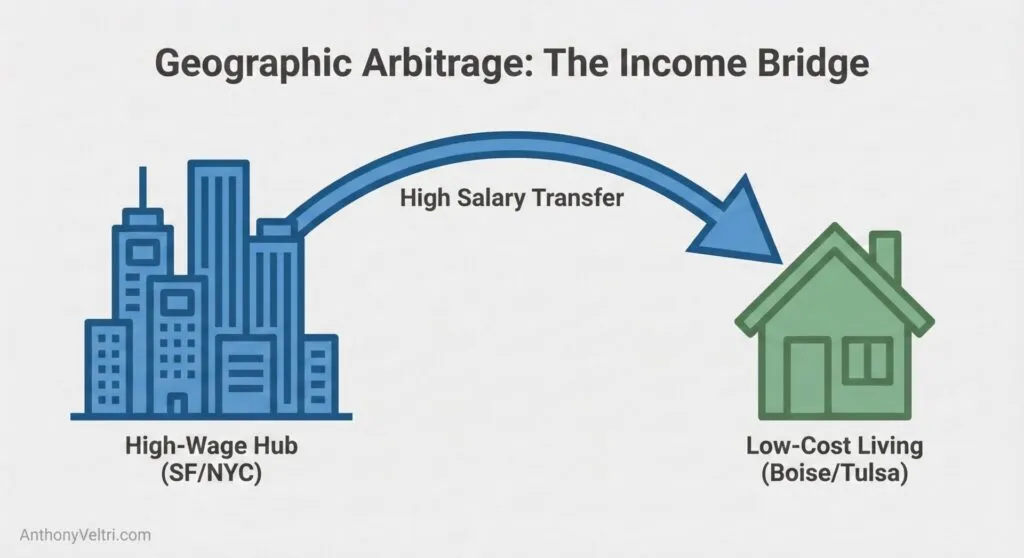

Remote Work: The New Geographic Arbitrage #

Post-COVID structural shift: Many professional jobs can be done remotely. This creates a new optimization strategy that didn’t exist 5 years ago.

STRESS TEST: THE $110K TRAP (VIDEO) #

Zero Slack is Zero Wealth.

In this clip, I state that $110k “isn’t enough.” To be clear: That is a fantastic salary, but it is a dangerous illusion if it comes attached to a “Tier 1 City” cost structure. If your rent, taxes, and student loan service consume 95% of your take-home pay, your Structural Wealth is zero. The goal isn’t just to make the money; it is to escape the drag that burns it. We treat a six-figure salary like a magic wand that waves away math. In this video briefing, we run the “Landed Cost” analysis of a Junior Finance career in NYC versus a Teacher on the 5-Year Runway. The result? The “Rich” banker is living on $46 a day with zero slack, while the Teacher is building a fortress. High income does not fix a tightly coupled lifestyle.

The Remote Work Advantage #

The strategy: Earn SF/NYC/Boston salary while living in Boise/Pittsburgh/Nashville/Raleigh.

Example calculation:

- SF software engineer salary: $110,000

- Boise cost of living: ~40% lower than SF

- Boise living cost: ~$36,000/year (vs $75,000+ in SF)

- Loan payment: $16,000

- Total net needed: $52,000

- Gross needed (with Idaho state tax ~6%): $55,319

Result: Solvency achievable on a salary that would be underwater in SF. Aggressive payoff possible. No family runway needed.

Even better: Remote + Runway:

- $110k salary, live at home, $15k token

- Net needed: $31,000

- Massive surplus: $50k+/year after taxes and costs

- Debt gone in 2-3 years

- This is the nuclear option for debt elimination

The Catch (Not Everyone Can Do This) #

Not all employers allow full remote in any location:

- Some require proximity to office (1-2 days/week in-office = must live within commute distance)

- Some adjust salary for lower cost-of-living locations (negating part of the advantage)

- Some require residence in specific states for legal/tax reasons (payroll, benefits compliance)

Not all careers are remote-friendly:

- Medicine, nursing, physical therapy, veterinary (hands-on work)

- Many entry-level roles require office presence for training/mentorship

- Some fields have strong in-person culture (finance, consulting)

Not all people want remote:

- Career networking happens in person

- Mentorship is easier face-to-face

- Some people hate working from home

- These are real tradeoffs, not just logistics

Strategic Considerations #

If remote work is available in your field:

- It can replace or complement the home runway

- You get independence AND favorable economics

- Still requires discipline to direct surplus to debt (lifestyle creep is real)

If remote work is not available:

- Home runway becomes even more valuable

- Or: Choose field/employer that offers remote flexibility

- Or: Plan for eventual transition to remote work (build skills, network)

Bottom line: Remote work is a powerful tool for those who can access it, but not universally available.

Home runway works for everyone. Remote work works for some. Best strategy: Both.

Income-Driven Repayment Plans: Why the Runway Is Still Better #

People always ask: “What about IDR (Income-Driven Repayment) plans? Can’t you just make small payments based on income?”

Short answer: Yes, but it’s a trap for most people.

What IDR Plans Offer #

Income-Based Repayment (IBR), Pay As You Earn (PAYE), SAVE plan (new as of 2024):

- Monthly payment capped at 10-15% of discretionary income

- “Discretionary income” = your income minus 150% of poverty line

- Forgiveness after 20-25 years

- Lower monthly burden than standard 10-year plan

Example: $120k loan, $55k salary, single

- Standard plan: $1,330/month

- PAYE plan: ~$300-$400/month (varies by plan and family size)

- Difference: $900-$1,000/month relief

Sounds great, right? Here’s why it usually isn’t.

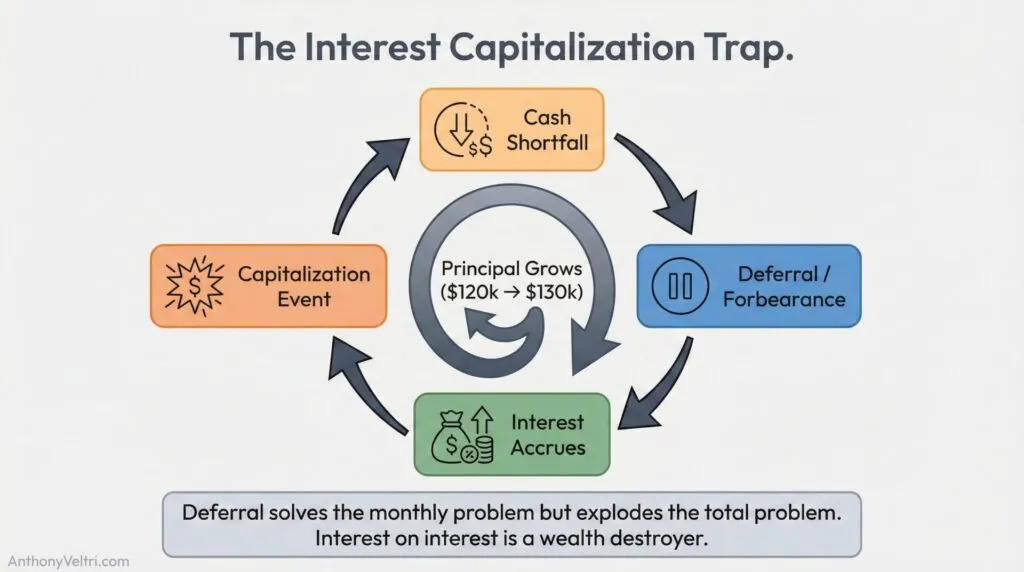

Why IDR Extends The Problem #

1. Longer timeline = massively more total interest

- Standard 10-year: Total paid = $160k (principal + interest)

- IDR 20-year: Total paid = $200k-$280k

- You pay $40k-$120k more in interest for the “convenience” of lower monthly payments

2. Interest capitalization risk

- If your monthly payment doesn’t cover interest accrual, the balance grows

- Example: Your loan accrues $600/month in interest, but your IDR payment is $400/month

- The extra $200/month gets added to principal (capitalization)

- Now you’re paying interest on interest

- Your $120k loan can become $150k or $180k over time

This is the default outcome if you don’t actively plan.

3. Forgiveness is taxable income (except PSLF)

- After 20-25 years, remaining balance is “forgiven”

- IRS treats forgiveness as income

- Example: $60k forgiven after 25 years = **$60k added to your taxable income that year**

- Could trigger $15k-$25k tax bill

- You need to have that cash ready or end up in tax debt

- Exception: Public Service Loan Forgiveness (PSLF) is tax-free, but requires 10 years in qualifying nonprofit/government job

4. Opportunity cost is enormous

- 20-25 years of monthly payments, even if lower

- Delays when you can invest, buy home, start business, take career risks

- Psychological burden of debt for two decades

- Many life decisions (marriage, kids, location) constrained by debt for 20+ years

The Runway Alternative #

5-year home runway:

- Payoff in 5-6 years for median earner

- Total interest paid: ~$18k-$25k

- No forgiveness tax bomb

- Debt-free by age 27-28 if starting at 22

- Next 15-20 years of would-be loan payments become savings/investment

The math is brutal:

- IDR path: Pay $400/month for 25 years = $120k in payments + $60k forgiveness = $180k total + $20k tax bill = **$200k total**

- Runway path: Pay $2,500/month for 5 years = $150k total, done by age 27

After age 27:

- IDR person: Still paying $400/month for 20 more years

- Runway person: Investing $2,500/month, building wealth

20-year wealth difference: $500k-$1M depending on returns

That’s not a small difference. That’s “retire 10-15 years early” difference.

When IDR Makes Sense (Rare Cases) #

Pursuing Public Service Loan Forgiveness (PSLF):

- Government or 501(c)(3) nonprofit career

- 10 years of payments → tax-free forgiveness

- If you’re committed to qualifying employment, IDR + PSLF can be optimal path

- But: Must stay in qualifying job, many applications denied historically, rules change

Income will remain very low:

- If career path has limited earning potential (social work, ministry, nonprofit, education in low-paying district)

- IDR payments could be minimal for 20 years

- Forgiveness tax bill might be manageable relative to lifetime earnings

- Still: Long psychological burden of debt

Near-term cash flow crisis:

- Need breathing room immediately (health crisis, family emergency, job loss)

- IDR can provide temporary relief

- But: Plan to transition to aggressive payoff when income improves

- Don’t let temporary relief become permanent strategy

The Structural Closure of Essential-But-Invisible Careers #

The current debt structure makes entire categories of essential work mathematically impossible without intervention.

I call these “hemorrhoid cream economy” careers:

- Essential for society to function (teaching, social work, nursing, nonprofit)

- High utility, high impact on real people’s lives

- But: Low status, low compensation, invisible in prestige hierarchies

The math doesn’t work:

- Teacher salary: $45k-$55k (varies by state, but median is low)

- Six-figure debt: $120k at 6%

- Standard payment: $1,330/month = $16k/year

- Living independently in city: $60k/year

- Total needed: $76k/year

- Gap to actual salary: $21k-$31k annual deficit

You cannot be a teacher with six-figure debt living independently. The equation is structurally impossible.

Your only options are:

- Home runway (if available) – makes the math work

- Public Service Loan Forgiveness (if you can stay in qualifying job for 10 years and navigate the bureaucracy)

- Don’t enter the field (which is what’s happening – we’re structurally closing these paths)

What this means for society:

We need teachers. We need social workers. We need nonprofit workers providing services that markets won’t. But we’ve made these careers financially suicidal for anyone with standard education debt.

The result:

- People from wealthy families can afford to teach (they don’t need the salary, or parents provide runway)

- People from poor families can’t afford to teach (can’t access runway, can’t survive on salary with debt)

- We’re selecting our essential workers by family wealth, not capability or calling

This is perverse. Society needs these roles, but the debt structure has made them structurally inaccessible to most people.

The runway partially solves this: A teacher earning $50k with runway can achieve solvency, pay off debt in 8-10 years, then live on teacher salary. Without runway, they’re underwater forever or forced out of the field.

But the larger point: We’ve built a system where essential work is financially impossible unless you have family wealth to buffer it. That’s not about individual choices. That’s a structural problem with how we fund education and compensate essential work.

I’m not solving that structural problem in this document. But I am documenting that the runway makes essential-but-invisible careers survivable when they’d otherwise be structurally closed.

If your kid wants to teach or do social work or nonprofit work, and you have runway capacity, that might be the only thing that makes it mathematically possible.

Bottom Line on IDR #

IDR is a tool, not a solution. It trades short-term monthly relief for long-term drag and much higher total cost.

The home runway is a solution. It changes the cash flow equation fundamentally and enables fast payoff on standard or aggressive schedules.

If you must use IDR: Treat it as temporary bridge, not permanent plan. Transition to aggressive payoff as soon as income allows. Track your loan balance monthly; if it’s growing, you’re in a capitalization trap.

The 5-Year Home Runway: Implementation Framework #

This is the practical section. If you’re going to do this, here’s how.

What It Is #

A time-boxed plan where a new graduate lives at home for 3-5 years, pays a token amount or contributes defined household work, and uses the savings to attack loans and build a cash cushion.

Not: Moving back home with no plan, drifting for years, regression to teenager status.

Is: A written contract between adults with clear expectations, timeline, and exit criteria.

Why It Works (The Mechanism) #

1. Cuts fixed living costs dramatically

- From ~$60,000/year in a starter city to token **$12,000-$18,000**

- The $40k-$48k annual savings is redirected to highest-return use

2. Enables aggressive principal prepayment

- Extra payments go entirely to principal (not interest)

- Cuts years off payoff timeline

- Reduces total interest paid by 50-70%

3. Reduces tail risk

- Less cash pressure = fewer skipped payments

- Fewer skipped payments = less interest capitalization

- Emergency fund builds faster, providing shock absorption

- Job loss or medical bill doesn’t spiral into default

4. Creates compounding advantage

- Once loans end (year 5-6), every former loan dollar becomes savings

- 15+ years of compounding before traditional payoff path would be debt-free

- By age 35-40, runway grad has $200k-$400k more net worth than independent peer

- The early head start matters enormously

What Good Looks Like #

Time-bound:

- Clear start and end dates (e.g., September 2025 to September 2030)

- Not open-ended “until you figure it out”

- Calendar date on the contract

Written agreement:

- Token contribution specified (cash or defined labor)

- Money rules documented (autopay amounts, surplus allocation, savings targets)

- House rules clear (quiet hours, visitors, shared spaces, privacy boundaries)

- In writing, signed, not just “we talked about it”

Performance-based:

- Exit milestones defined (debt zero, emergency fund complete, retirement autopay on)

- Progress dashboard visible to all parties (shared spreadsheet, app, whatever)

- Weekly check-ins on calendar/chores/finances

- If milestones aren’t being hit, escalate to discussion, not silent resentment

Respects adult autonomy:

- Not a return to high school rules

- Clear boundaries on privacy and independence

- Work hours and personal time protected

- Graduate is an adult guest, not a child

Why Family Agreements Fail Without Loop Closure #

Most family help arrangements fail not because of bad intentions, but because of missing loop closure.

I just wrote Doctrine 23: Loop Closure as Load-Bearing System Infrastructure. The runway agreement is a direct application of that principle.

What loop closure means:

- Verified message receipt (both parties confirm understanding)

- Explicit status reporting (progress dashboard visible to all)

- Regular synchronization points (weekly meetings, not annual “check-ins”)

- Clear escalation paths (friction gets addressed, not suppressed)

Why most family help fails:

No loop closure → expectations diverge silently → resentment accumulates → explosion

- Parent thinks: “They should be saving more, they’re wasting money”

- Child thinks: “I’m doing fine, $500/month is plenty”

- Neither knows the other’s expectation. Neither can verify status.

- Small friction (dishes piled up Tuesday) never gets addressed

- Builds for months until someone explodes over something trivial

- Relationship damaged, plan abandoned, child moves out bitter, parent feels taken advantage of

The weekly 30-minute meeting isn’t “nice to have.” It’s the structural element that prevents catastrophic failure.

What the weekly meeting does:

- Confirms mutual understanding (loop closure on expectations)

- Surfaces small frictions while they’re small (preventive maintenance)

- Provides verified status on milestones (shared dashboard, both can see progress)

- Creates space for adjustment without crisis (plan isn’t rigid, but drift is visible)

This is the same principle as status reporting in distributed systems. If components can’t verify each other’s state, the system will eventually desynchronize and fail. The failure isn’t because the components are bad. It’s because the interface lacks loop closure.

The progress dashboard (shared spreadsheet showing loan balance, emergency fund, retirement contributions) provides verified message receipt. Both parties can see:

- Is the loan decreasing on schedule?

- Is the emergency fund building?

- Are milestones on track for exit date?

Without this visibility, you get:

- Parent assumes child is saving, child is actually spending

- Child assumes parent is satisfied, parent is silently resentful

- By the time anyone realizes there’s drift, it’s a crisis

With visibility:

- At month 6: “Loan balance only dropped $2k, we expected $5k. What happened?”

- Not accusatory. Just: “The system isn’t performing to spec. What’s the deviation?”

- Addressed immediately, before it becomes a problem

Bottom line: The runway works when it has loop closure. Most family help fails because it doesn’t. The weekly meeting and shared dashboard aren’t optional bureaucracy. They’re the load-bearing elements that keep the interface from failing.

If you implement a runway without loop closure, you’re building the same system that fails for everyone else. Don’t skip this part.

The Math in One Page #

Assume:

- $120,000 loan at 6%

- Graduate earns $55,000 (median)

- Token living cost: $15,000/year

Path 1: Independent in city

- Cannot achieve solvency on median salary

- Forced into deferrals or IDR

- Loan drifts to 15-20 years with interest

Path 2: Home runway, standard payments

- Solvency immediate

- $10k annual surplus

- Payoff: ~5.3 years

- Saves 4.7 years vs 10-year plan

- Saves ~10-15 years vs independent path

Path 3: Home runway, aggressive target (4.7 years)

- Requires $59k gross income

- Achievable for median+ earners

- Or: Median earner with small side income ($5k/year)

- Total interest paid: $18k-$22k (vs $40k standard, vs $80k+ independent)

Bottom line: The runway converts a mathematically impossible situation into a routine monthly process that finishes years early. This isn’t marginal improvement. This is transformative.

How to Set It Up #

1. Choose the term

- Pick 3, 4, or 5 years based on loan size and income

- Put dates on paper

- Shorter is fine if loan is smaller or income is higher

- Longer than 5 years gets into diminishing returns (life happens, relationships form, etc.)

2. Set the token

- Cash: $12,000-$18,000/year ($1,000-$1,500/month)

- Labor: Defined hours/outcomes (school runs, meal prep, yard work, elder care)

- Hybrid: Part cash, part labor

- Must be specific and measurable (not “help out around the house”)

Example labor contributions:

- 2 school drop-offs per week (30 min each) = ~50 hours/year

- Weekly meal prep for household (2 hours) = 100 hours/year

- Bi-weekly yard maintenance (2 hours) = 50 hours/year

- Total: 200 hours/year at $25/hour equivalent = $5,000 value

- Plus $833/month cash = $10,000 cash

- Total token: $15,000/year

3. Lock the money rules

Loan:

- Autopay standard payment on 1st of month, non-negotiable

- Set up extra principal payments: 25-40% of monthly surplus goes to extra principal

- Never defer unless genuine emergency (unemployment, not “wanted to buy a car”)

Emergency fund:

- Open separate savings account (not checking)

- Deposit $500-$700/month until balance reaches 6 months of post-runway expenses (~$18k-$20k)

- This is your shock absorber for job loss, medical bills, car repairs

Retirement:

- Turn on employer match contributions once emergency fund reaches 3 months (~$9k-$10k)

- Not optional (“I’ll start later”); compound interest matters most when you’re young

4. Write house rules

Quiet hours:

- 10pm-7am weekdays

- 11pm-8am weekends

- Headphones after quiet hours, keep TV/music reasonable

Visitor policy:

- Partner welcome, discuss overnight in advance (not asking permission, just coordination)

- Friends welcome with notice

- No “can I have the house to myself this weekend” unless extraordinary circumstance

Shared spaces:

- Kitchen/living room available to all

- Clean up after yourself immediately (dishes, food, messes)

- Fridge space allocated

Weekly meeting:

- Sundays 6pm for 30 minutes

- Review: calendars for the week, bills/money status, chores completion, any friction points

- This prevents small annoyances from becoming big fights

5. Define exit milestones

Graduate leaves when ALL of these are met:

- Loan balance: $0

- Emergency fund: $18,000 (6 months of post-runway living expenses)

- Retirement: Auto-contributing 5% minimum (ideally to employer match)

- Job: Completed one full annual review cycle (shows employment stability)

When all milestones met: Runway ends on schedule. If early, great. If delayed by 3-6 months due to circumstances, discuss extension. If delayed by >6 months, something is wrong; investigate whether plan is failing.

Financial liftoff is a sequence, not an event. These four milestones aren’t polite suggestions; they are mechanical prerequisites. Until every single clamp releases, you are grounded by design.

Figure 7: The Launchpad. You cannot fly until the clamps release. Leaving before these four milestones are met is not a launch; it’s an abort.

10-Minute Implementation Template #

Copy this, fill in the details, sign it, done.

HOME RUNWAY AGREEMENT

Duration: September 1, 2025 to August 31, 2030 (5 years)

Parties: [Graduate Name] and [Parent(s) Names]

TOKEN CONTRIBUTION: $15,000/year ($1,250/month equivalent)

Cash: $1,000/month

Labor: $250/month equivalent value

- 2 school drop-offs per week (Mon/Wed, 7:30am)

- 1 weekly meal prep (Sunday afternoon, family dinner)

- Yard maintenance bi-weekly (mowing, edging, trimming)

MONEY RULES:

Loan:

- Autopay $1,330 on 1st of every month

- Extra principal: 30% of monthly surplus

- No deferrals without joint discussion

Emergency Fund:

- Target: $18,000 (6 months post-runway expenses)

- Deposit: $500/month until full

- Separate savings account, not touched except genuine emergency

Retirement:

- Start employer match (5%) when emergency fund reaches $9,000

- Increase to 10% when emergency fund full

HOUSE RULES:

Quiet Hours: 10pm-7am weekdays, 11pm-8am weekends

Visitors: Partner/friends welcome with heads-up, overnight discussed in advance

Shared Spaces: Kitchen/living room shared, clean up immediately

Weekly Meeting: Sundays 6pm, 30 minutes, review week and finances

EXIT MILESTONES:

- Loan balance: $0

- Emergency fund: $18,000

- Retirement: Contributing 5%+ on autopay

- Job: Completed one annual review cycle

When all milestones met: Agreement ends, [Graduate] transitions to independent living

SIGNATURES:

[Graduate]: _________________ Date: _______

[Parent(s)]: _________________ Date: _______

That’s it. 10 minutes to document what could save $100k and 10 years.

How This Respects Adulthood #

This is not regression to childhood. Let me be very clear about this because the cultural narrative is “moving back home = failure.”

It’s not:

- Parent controls your life

- You’re treated like a teenager

- Curfews, permission-asking, loss of autonomy

It is:

- A contract between adults

- Swaps rent for focused financial optimization

- Time-limited with clear exit criteria

- Both parties benefit

How it protects graduate dignity:

- Expectations in writing (not arbitrary or changing)

- Privacy boundaries documented

- Adult autonomy over career, social life, decisions

- Exit criteria clear (you know exactly what you’re working toward)

How it protects parent boundaries:

- Time limits prevent indefinite dependence

- Token contribution means graduate isn’t “free-loading”

- Performance requirements (autopay, savings) mean progress is happening

- Financial caps (no open-ended support)

Bottom line: This is strategic financial planning, not arrested development. Anyone who thinks living at home for 5 years to be debt-free by 27 is “failure” while living independently to be in debt until 40 is “success” has confused cultural scripts with actual outcomes.

Sibling Fairness: Two Simple Models #

If you have multiple children, you need a policy that’s perceived as fair. Pick one and apply it consistently.

Model 1: Equal Years

- Every child gets same offer: 3, 4, or 5 years

- Doesn’t matter if they need it all

- Treats time as the equal resource

- Child A uses 5 years, Child B uses 3 years; both got the same offer

Model 2: Equal Dollars

- Household caps support at total per child (e.g., $60,000 total value)

- Calculate: 5 years × $15k token = $75k value, but cap at $60k

- Child finishes in 3 years: They used $45k of their $60k, that’s fine

- Child uses full 5 years but exceeds $60k: Household absorbs overage OR child pays difference

- Remaining unused allocation doesn’t transfer to other children

Which to choose?

- Equal years: Simpler, easier to explain, feels more “fair” to most families

- Equal dollars: More precise, better if kids have very different situations (one has scholarship, one has debt)

Both work. Just pick one, document it, and stick to it.

Common Failure Modes and Fixes #

Plans fail predictably. Here’s how to avoid the common traps.

Failure Mode 1: Vague token drifts to nothing

- Graduate “helps out” but it’s not defined

- Parents feel taken advantage of

- Graduate feels like they’re doing enough

- Resentment builds

Fix:

- Weekly checklist with measurable outcomes

- Example: “Yard mowed and edged, photo sent to family group chat by Sunday 5pm”

- Chore done = token credited

- Chore not done = discussion at weekly meeting

Failure Mode 2: No end date, runway becomes permanent

- Graduate is comfortable, doesn’t push to finish

- Parents are comfortable, don’t enforce exit milestones

- 5 years becomes 7 becomes 10

- Everyone loses

Fix:

- Calendar date specified in agreement

- Exit milestones tracked publicly (shared spreadsheet)

- At 4.5 years, sit down and say “We’re 6 months from scheduled exit, are we on track?”

- If milestones aren’t met, discuss: extend 6 months with concrete plan, or graduate leaves anyway and figures it out

Failure Mode 3: Lifestyle creep consumes surplus

- Graduate gets used to having income with low costs

- Buys car, upgrades wardrobe, travels, eats out constantly

- Surplus disappears into consumption

- Loan payoff doesn’t accelerate

Fix:

- Autopay to loans and savings on payday, before discretionary spending

- Set up: Paycheck → Checking. Day 1: Autopay $1,330 to loan. Day 2: Autopay $500 to emergency fund. Day 3: Autopay 30% of remaining surplus to extra principal.

- What’s left is discretionary

- Can’t spend what’s already gone to savings/debt

Failure Mode 4: Family friction escalates

- Small annoyances (dishes, noise, schedules) accumulate

- Nobody addresses them directly

- Resentment builds until explosion

- Ruins relationship and plan

Fix:

- Weekly 30-minute meeting for airing concerns

- “This week the dishes piled up Tuesday and Friday, can we address this?”

- Address issues when they’re small, not when they’re huge

- If something is bothering someone, it gets raised at weekly meeting, not passive-aggressive comments

Failure Mode 5: Graduate feels infantilized

- Parent treats graduate like teenager (unsolicited advice, intrusive questions, comments on choices)

- Graduate regresses or rebels

- Dynamic becomes parent-child instead of adult-adult

Fix:

- Adult-to-adult framing in agreement

- Graduate has agency over career, social life, personal decisions

- Parent doesn’t get input on these unless asked

- Privacy boundaries in writing

- If parent violates boundaries, graduate can point to agreement: “We agreed on privacy for my room and my schedule”

What to Say to Skeptics #

People will have opinions. Here’s how to respond.

“This is avoiding adulthood.” → No, it’s a five-year financial optimization plan. Adulthood is making strategic choices, not following arbitrary cultural scripts about independence timing. Paying interest on debt for 20 years because you moved out at 22 is not more “adult” than being debt-free at 27.

“Renting builds character.” → Renting a room at market rate while carrying six-figure debt builds nothing but interest payments. We’d rather buy back those years for our child. Character is built through challenges, not through unnecessary financial hardship.

“What about privacy and dating?” → The agreement specifies privacy boundaries and visitor policies. Adult relationships can coexist with financial strategy. People dated and got married when multi-generational housing was normal. It’s only weird because our culture says it is.

“Won’t they become dependent?” → The agreement is time-limited and performance-based. Exit milestones ensure they leave with financial resilience: debt-free, emergency fund built, retirement started. That’s not dependence; that’s a launchpad.

“I moved out at 18 and figured it out.” → Great. How much debt did you have? What was rent in 1985? The structural economics have changed. What worked in 1985 or 1995 or even 2010 doesn’t map to 2024. Landed costs are higher, debt loads are higher, entry salaries haven’t kept pace. We’re optimizing for current conditions, not nostalgia.

Opportunity Costs of the Home Runway

The runway is not cost-free, even if financially optimal. Worth acknowledging what you trade.

Non-Financial Costs #

Independence experience:

- Living alone teaches practical skills: cooking, cleaning, budgeting, maintenance

- Some of this can be learned at home, some is different when it’s “your place”

- Mitigation: Give graduate real autonomy within home (not infantilization)

Career networking:

- Living in city center vs parents’ suburb may affect after-work networking

- Less spontaneous colleague socialization (“grab drinks after work?”)

- Happy hours, professional events, conferences may be harder to attend

- Mitigation: Intentional networking effort, attend events, host when possible

- Also: Remote work makes location less critical for networking in many fields

Relationship development:

- Dating and relationship building can be more complex

- Some partners will see home-living as red flag (even if financially strategic)

- Overnight guests require coordination (not asking permission, but coordination)

- Mitigation: Clear explanation of time-bound financial strategy, demonstrate adult autonomy

- Reality: If partner can’t understand strategic financial planning, that’s useful information about compatibility

Privacy and autonomy:

- Even with good boundaries, living with parents is different than living alone

- Less freedom for lifestyle choices, guests, schedule

- Parents may give unsolicited advice or commentary (even if trying not to)

- Mitigation: Explicit privacy agreements in writing, but tradeoff still exists

Geographic limitation:

- May constrain job search to commutable distance from parents’ location

- Could miss optimal career opportunities in other cities

- Mitigation: Remote work (if available), or accept that geography is part of the package

- Or: Choose parents’ location strategically if they’re in good job market

Social perception:

- Some peers will judge (even if financially ignorant)

- Cultural messaging that independence at 22 is mandatory

- “Still living with your parents?” carries stigma

- Mitigation: Confidence in your strategy, find like-minded community, ignore financially illiterate opinions

- Reality: People who mock strategic planning while drowning in debt are not authorities on life choices

The Tradeoff Assessment #

Financial benefit:

- 5 years earlier debt-free (vs independent path)

- ~$100k-$200k higher net worth by age 35

- Much lower tail risk of financial crisis

- Earlier ability to invest, buy home, start business, take career risks

Non-financial costs:

- 5 years of reduced independence

- Some career/networking limitations

- Relationship complexity

- Social judgment

Is it worth it?